In Australia, property values are rising faster than we have seen since October 1988, which is 32 years?. In fact, all capital cities and regional areas have risen at least 1.4% in the past month. Sydney leads the charge with 3.7% for the month and 6.7% for the quarter. This is staggering considering they recorded a -14.9% drop in values through to May 2019, not even including the -2.9% drop during COVID Lockdowns in 2020! This is all still on the back of a strong economic outlook, low interest rates, government incentives, strong mining & construction, successful vaccine rollout, strong migration back to Australia, and not to mention the huge backlog of immigrants waiting to enter reaching the hundreds of thousands. These circumstances have now left inventory at an all-time low. It’s all about supply and demand and the demand is high while the stock is low, so here we go again.

Australian Changes in Property Value – March 2021

The writing is on the wall. The market is in full swing BOOM ? So, if you are looking to take advantage of this boom, make some money, and you can afford it – the answer is simply BUY, BUY, BUY. However, if you already own real estate and can afford it – HOLD, HOLD, HOLD. If you are carrying debt, perhaps it’s a better time to take advantage of the increase in money going around and pay down some of it. This will also put you in a better position when the heat comes off and property prices begin to subside a little. The good news is, there is no end in sight at the moment, so it could be a long wait.

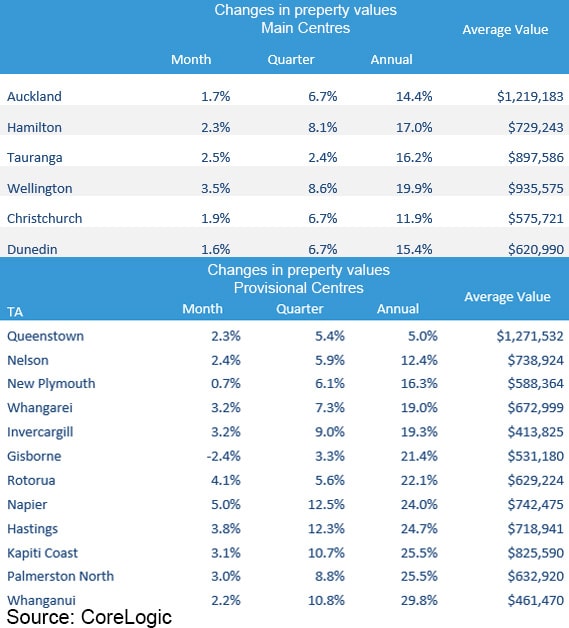

NEW ZEALAND

Well, if you thought Australia was humming, then check out New Zealand! With growth in the last 12 months hitting 14.5%, the highest it’s been since October 2016, it is travelling so well that the Government is intervening with a LOAN -TO -VALUE ratio restriction and minimum 20% deposits. The hard-line has been taken by the government to reduce speculator activity and support more sustainable house pricing making it more affordable for first home buyers.

Each of the 6 main centres have experienced annual growth of more than 10% with Wellington topping the rises with 16.6%. Other than the obvious indicators experienced in Australia, limited stock levels, slow reaction to development, and restricted infrastructure have continued the upward trend. Although returns are huge, the new measures mentioned are set to slow down growth and bring the market off the boil.

Disclaimer – All info is taken from CoreLogic and although as much attention has been taken to report fairly, some opinions have been expressed and should not be taken as advice but rather an opinion.